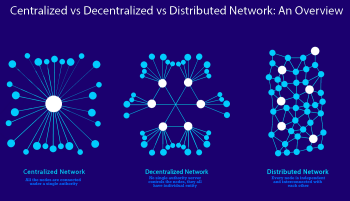

The internet has become one of the major aspects of the life of people worldwide. Technological advancements have offered new definitions for the ways in which people interact with technology. The DeFi vs. web3 debate is one of the notable examples of the ways in which innovation in technology leads to the discovery of new value advantages. Blockchain offered a new method for storing data and processing transactions with a decentralized network of computers.

Therefore, developers could come up with DeFi, as a means for enabling access to financial services without intermediaries. At the same time, the web3 vs. DeFi comparisons also point to the ways in which blockchain offers the right tool for decentralization in web3. The following post offers you a detailed overview of DeFi and Web3 alongside a discussion on the differences between them.

The Arrival of Web3 and DeFi

The most common technology used worldwide is the internet, which has been improving constantly since its origins. You can find a better impression of the DeFi vs. Web3 difference by reflecting on the different phases of technological advancements in the internet. The earliest version of the internet, which was available for public use, was known as Web 1.0. In the first stage, the internet only offered basic websites and applications which offered information. The developments in Web 1.0 provided the foundations for the dot-com boom alongside its impact on generating growth.

The next stage of the Internet emerged in the form of Web 2.0, which offered a user-centric and interactive Internet. Web2 introduced a new user-centric and interactive internet where users can create and share content. Most of the top platforms on the internet, such as Facebook, YouTube, Instagram, and Twitter, have emerged in the web2 space. However, web2 presents the problem of centralized architectures and rent-based economic models.

You can find answers to “What is DeFi and Web3?” in the problems associated with existing forms of digital interactions. Web3 represents the third generation in the evolution of the internet and uses blockchain technology to provide truly user-centric experiences. DeFi is the term used to describe a new category of financial services based on blockchain technology for decentralization. It provides a new approach to a dynamic ecosystem featuring open platforms and financial products and instruments. DeFi is one of the subdomains in the larger web3 landscape.

Diving Deeper Into Fundamentals of DeFi

You can find better responses for the difference between DeFi and web3 by reflecting on the fundamental definitions associated with DeFi. The answers to “Are DeFi and Web3 the same?” would point at the definitions of both terms. DeFi serves as an example of an emerging financial system in web3 with the facility of new approaches for value creation and utility.

Web3 serves as a new paradigm for user experiences on the internet. It focuses on the assurance of using blockchain to offer more democratic control over user data. DeFi has also become a new paradigm for a transparent financial system that offers new approaches to utility and value. The responses to “What is the difference between DeFi and Web3?” would also reflect on how DeFi works to improve financial utility. It is a promising subsector in the field of web3 and offers a broad range of services. DeFi solutions help users in managing their assets in a non-custodial manner by using DeFi crypto wallets. Here are some of the popular DeFi solutions which have gained the attention of users.

Decentralized exchanges, or DEXs, are one of the foremost examples of DeFi solutions. DEXs offer a peer-to-peer marketplace where users can exchange crypto assets with the advantage of non-custodial solutions. The next popular example of DeFi applications points to peer-to-peer lending and staking platforms.

As a matter of fact, you can find multi-purpose peer-to-peer money markets with a diverse range of products and services suited for DeFi platforms. Decentralized money markets help users in borrowing, lending, and staking crypto assets by offering liquidity in the protocol through liquidity pools. Another noticeable example of DeFi solutions that have been gaining momentum in recent times points to synthetic assets.

The discussions around DeFi vs. web3 also draw attention to the applications of DeFi services for transferring, using, storing, and trading different types of crypto assets, such as stablecoins, liquidity provider tokens, governance tokens, and utility tokens. On top of it, DeFi also suggests the possibilities for mainstream adoption of central bank digital currencies across the legacy financial infrastructure.

Impact of Web3 on DeFi

The interplay between DeFi and web3 has been one of the notable reasons for fuelling concerns regarding the web3 vs. DeFi comparison. Web3 technology provides viable improvements in the secure and decentralized nature of DeFi, which lead to more value advantages. As a result, DeFi could provide better trust, accountability, transparency, and accessibility of the financial systems.

The radical growth in the popularity of cryptocurrencies in recent times has led to a higher pace of innovation and development in web3 and blockchain. Considering the role of web3 as the future of internet, it has been expected to come up with new approaches that dictate the functions of money in the financial world.

The outline of the DeFi vs. Web3 difference would revolve around the potential of web3 for supporting DeFi customers. The number of internet users continues to grow every year, with around 5.07 billion users in 2022. Therefore, it is clearly evident that the transition of users to web3 would provide benefits to DeFi ecosystem in terms of the number of users.

It is also important to remember that digital assets such as cryptocurrencies are gradually becoming a popular form of payment. Interestingly, the younger generation is more drawn towards digital assets such as cryptocurrencies and NFTs. The preferences for a cashless lifestyle and faster evolution of technology would ensure that DeFi would become a mainstream choice for financial services.